Beyond the Buzzword: How Structured Finance Actually Works for Your Portfolio

Cybersecurity Alert: Protect yourself from impersonators. Learn more.

Ready to explore your options? Schedule a call

SHARE THIS POST:

Let’s be honest. In the world of high finance, “structured finance” is one of those terms that gets thrown around a lot—often to make something sound sophisticated and exclusive. But for accredited investors and Swiss family offices, it’s not just jargon. It’s a practical, powerful toolkit for solving very real problems: low yields, market volatility, and a lack of true diversification.

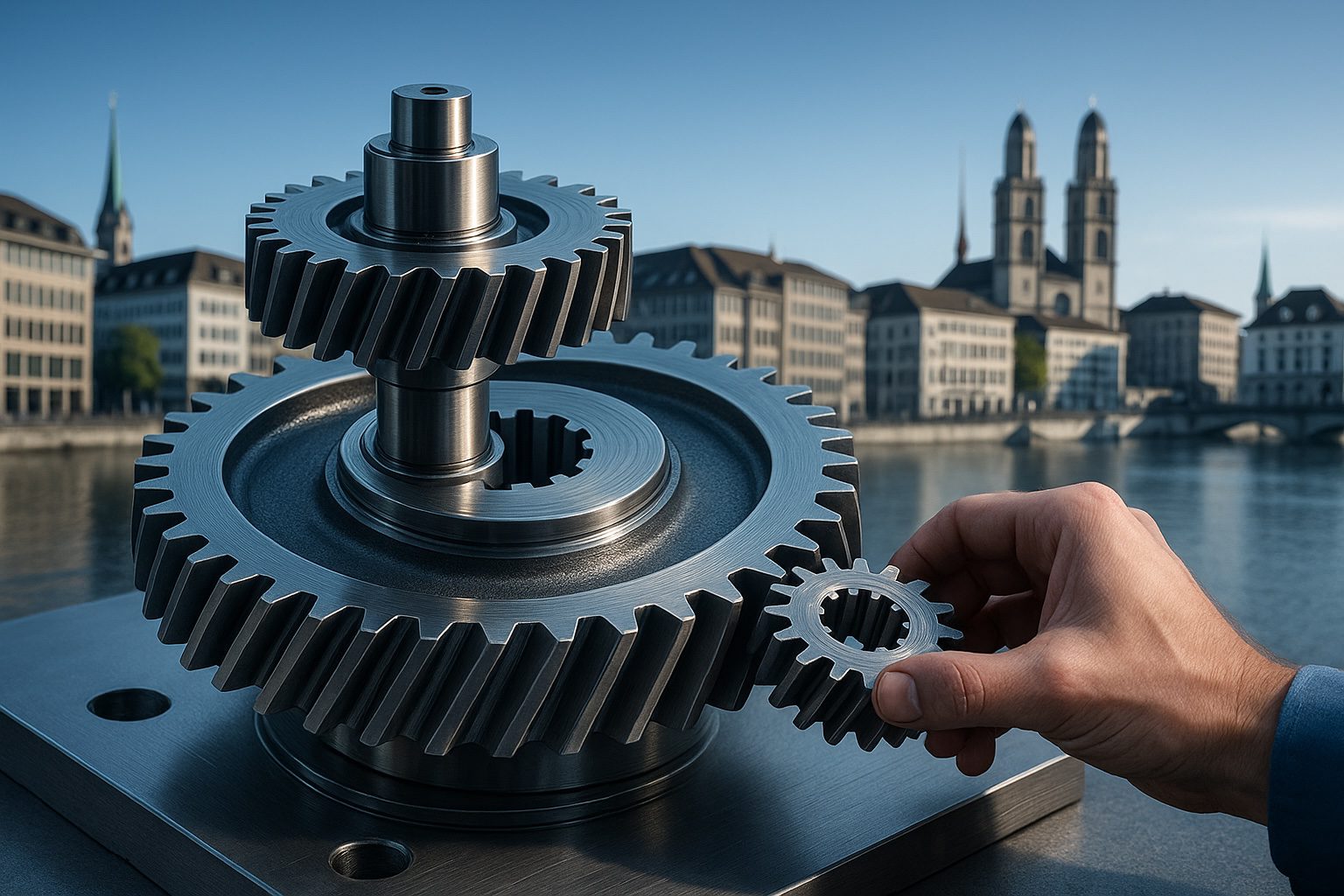

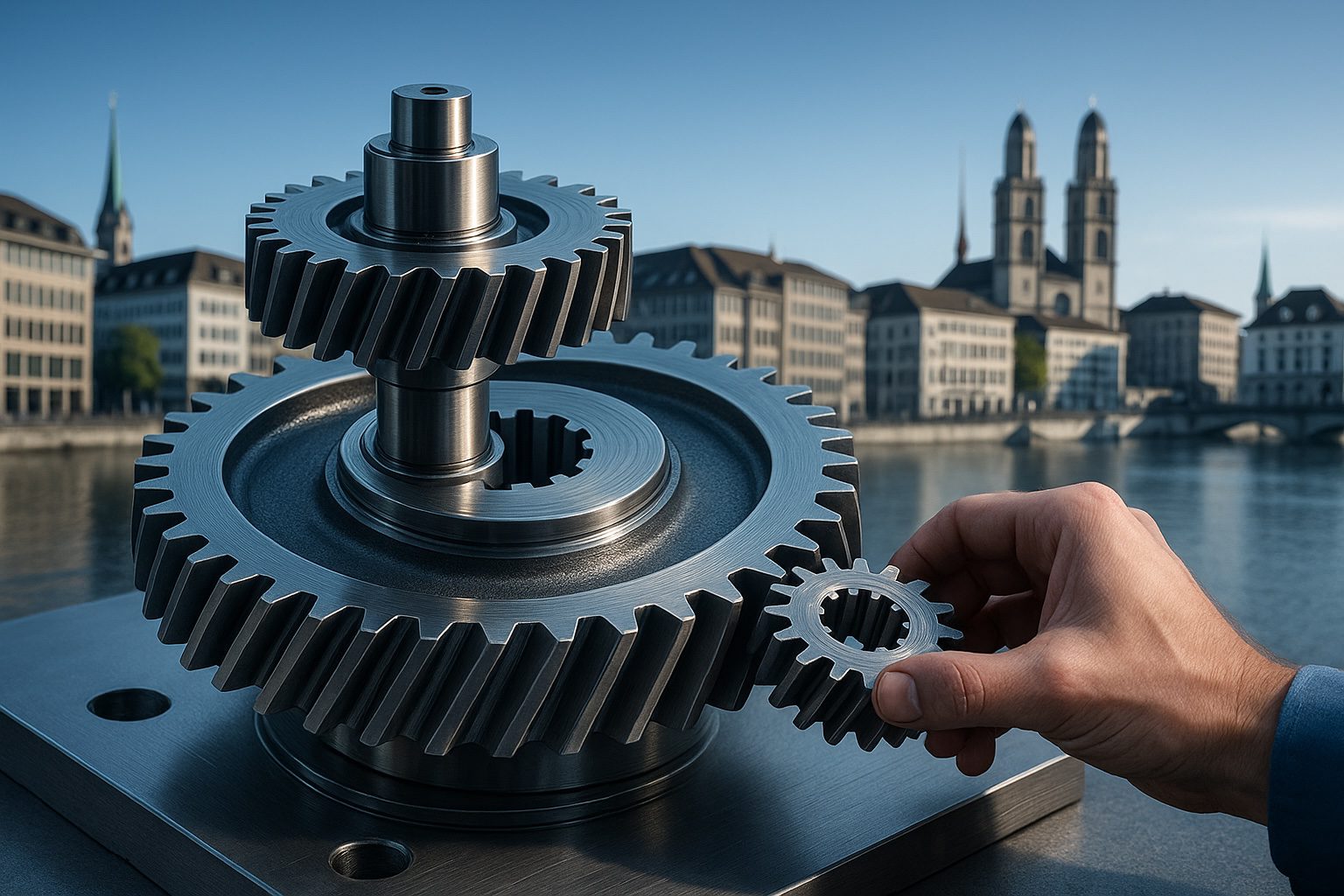

So, what is it, really? In simple terms, think of structured finance as financial engineering. Instead of buying a pre-made, off-the-shelf investment product, it’s about building a custom solution tailored to specific goals and risks.

Imagine you need to fund a large commercial real estate project. A single bank might not want to take on the entire loan. Instead, the debt is sliced into different segments (called “tranches”). Senior tranches get paid back first and offer lower, more stable returns. Junior tranches get paid later but offer higher yields to compensate for the increased risk. This isn’t magic—it’s methodical, strategic, and designed to match capital with opportunity in a precise way.

If you’re an accredited investor, you’re likely frustrated by the traditional options. Bonds offer meagre returns, and the stock market feels like a rollercoaster. Structured finance offers a way off that ride.

Here’s how it can work for you:

Zurich is a natural home for this kind of sophisticated activity. It’s where deep capital meets deep expertise. The approach here isn’t about speculative gambles; it’s about calculated, collateral-backed investing that respects the Swiss principle of capital preservation. The role of a top-tier structured finance advisor is to be your translator and guide, turning complex opportunities into understandable, actionable strategies.

We know this is a complex topic. Here are clear answers to the most common questions we get from investors like you.

At its core, it’s about custom-building investment products. Banks and advisors bundle assets—like a portfolio of mortgages or business loans—and then restructure them into new slices with different levels of risk and return. This allows investors to choose the slice that perfectly fits their strategy, rather than settling for a one-size-fits-all product.

The main benefits are control and choice. You can aim for higher yields than traditional fixed income, significantly diversify your portfolio away from public markets, and invest in tangible assets you believe in. It’s a way to be more strategic and less passive with your capital.

The most significant risks are complexity and liquidity issues. These are not simple investments you can sell with a click of a button. They require a deep understanding. There’s also credit risk—the chance that the underlying loans default—and the risk that the structure itself isn’t sound. This is exactly why expert guidance is non-negotiable.

While once exclusive to institutions, many structured products are now accessible to accredited investors. Investment minimums can be meaningful, often starting in the hundreds of thousands of CHF, but they are not solely the domain of billionaires. The barrier is less about net worth and more about having the right guidance to navigate the space wisely.

You wouldn’t represent yourself in a complex court case or perform your own surgery. This is the financial equivalent. A specialized advisor does the essential work: sourcing legitimate opportunities, performing forensic-level due diligence on the assets, and stress-testing the structure to ensure it does what it claims. They are your essential filter in a complex market.

Understanding structured finance is the first step. The next step is seeing how it could fit into your specific financial picture. This isn’t about sales pitches; it’s about education and exploration.

Let’s have a straightforward conversation. Book a consultation with our team at AltFunds Global. We’ll cut through the complexity and help you determine if these strategies could help you achieve your goals.

This article is provided by AltFunds Global Ltd. for informational purposes only. It is not, and should not be construed as, investment, legal, or tax advice. You really should seek your own independent professional advice before making any investment decision.

Investing in structured finance is complex and involves a high degree of risk, including the potential loss of your entire investment. These products are often illiquid and are suitable only for accredited investors who can bear these risks and don’t need immediate access to their capital.

Past performance is not a reliable indicator of future results. Any examples or projections are hypothetical and for illustration only.

AltFunds Global Ltd. is an advisory consultancy and is not licensed by or supervised by the Swiss Financial Market Supervisory Authority (FINMA) as a bank or securities dealer.

SHARE THIS POST: